Already signed up for an Apple Card and find it a great, modern credit card with its slick iPhone app and easy reporting? I’m a fan too. In cooperation with Goldman Sachs Bank, Apple just announced a high yield savings account too! Here’s how to get it all set up…

I’ve been a fan of the Apple Card since I first signed up back in 2019. Haven’t signed up for one yet? It’s a good addition to your credit portfolio and offers terrific reporting and tracking. Here’s my tutorial on How to Sign Up for an Apple Card. While the physical card has aged poorly in my leather wallet (it’s a dirty orange nowadays, not a shiny white) 99% of my use is through my iPhone with the ole’ double-click on the power button to pay, and that’s just as easy as it was the first time I used it.

While credit cards offer value through deferring payment, the banks generally make more money than we do through transaction fees and interest. Sidestep some of this by making your full payment each month, but why don’t we see some of the financial upside from working with these banks? Apple’s addressed that a little bit through its Daily Cash. As it’s now described: “With every purchase, get up to 3% Daily Cash back to spend or save.”

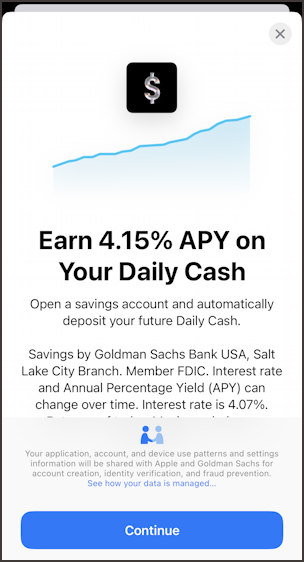

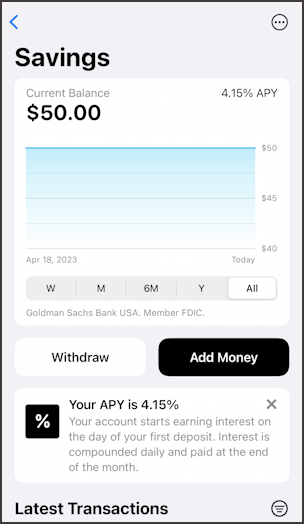

What’s new with the Savings account is that you’ll actually earn interest on the money you have sitting in the Apple (well, Goldman Sachs) bank.  Since they loan out your money to others and earn 15% or more, it seems fair, and the current interest rate is a decent 4.15% APY. Generally, the higher loan interest rates are – and the current Prime Interest Rate as I write this is 8.00% – the higher the yield on savings accounts too.

Since they loan out your money to others and earn 15% or more, it seems fair, and the current interest rate is a decent 4.15% APY. Generally, the higher loan interest rates are – and the current Prime Interest Rate as I write this is 8.00% – the higher the yield on savings accounts too.

Note: Wondering what APY means? It’s Annual Percentage Yield and, as Investopedia explains, it’s “the actual rate of return that will be earned in one year if the interest is compounded.”. If I started with $100 in the account, one year later with a 4.15% APY I’d have $104.15. Not a lot, but better to have it increase than decrease, right?

What makes the Apple Savings account so interesting is that your daily cash can automatically be dropped into your Savings account, ever so slowly earning even more money for you through the magic of APY interest. Anyway, anyway, let’s look at how to sign up for a Savings account if you already have an Apple Card!

FIND THE SAVINGS ACCOUNT SIGNUP LINK

While you might be lucky when you go into the Wallet app on your iOS device and see a promo banner, odds are that you won’t see any sort of link, which means you’ll have to hunt it down. In Wallet, tap on your card graphic, then choose “Card Details” from the “•••” menu. Swipe down just a bit and it’ll show this:

Tap on “View Apple Card Benefits” and it’ll open up an associated Web page in Safari that includes this:

It’s a bit of a roundabout path, but now you can tap on “Get started with Savings” and it will move you back into Wallet with the first informational screen about the Savings account:

Notice the small print that says the interest rate can change over time. The actual interest rate is 4.07% but with compounding the APY is 4.15%. If the prime interest rate drops, the savings APY will drop too. If it goes up (a typical indicator of inflation) then the savings account will go up too.

To continue and sign up, tap on the big blue “Continue” button.

SIGNING UP FOR AN APPLE SAVINGS ACCOUNT

You’ll be asked to confirm your account details, most especially your social security number (SSN):

Your SSN has become an important data item for identity theft, so it’s smart to be very careful about where you share the number, particularly the full 9-digit value as this is prompting for above. Apple says “Your Social Security Number will not be stored or read by Apple.” because it’s being given directly to the underwriting bank, Goldman Sachs. Ready to proceed? Enter your SSN then tap “Next”.

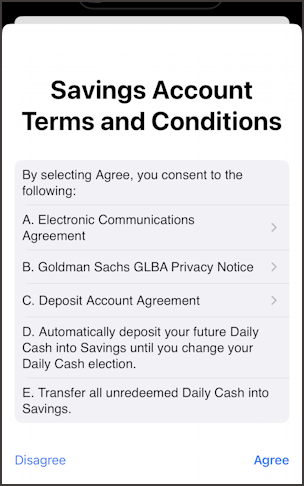

Read through this carefully. The most interesting items are D and E in my opinion: all future Daily Cash will automatically be swept into your Savings account every night. No need to set things up once you’re approved, which is convenient.

To proceed, tap on “Agree“.

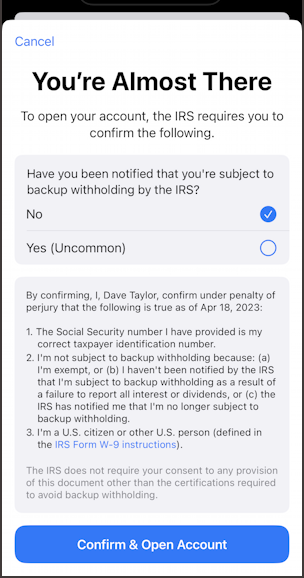

Now you need to indicate whether you have what’s known as “backup withholding” with the Internal Revenue Service (IRS), which you probably don’t. Here’s a bit more info if you’re curious: What is Backup Withholding?

I’m clear of this and, probably, you are too. Tap on “Confirm & Open Account” to apply for the Savings account (which hasn’t yet been approved by Goldman Sachs):

Hopefully, you’ll be approved as I was. if not, it should indicate the reason and you can inquire with your own bank or check your credit report to understand what happened.

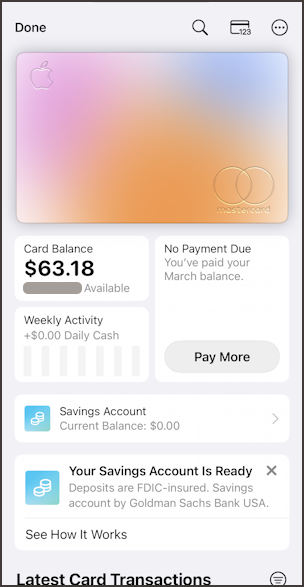

Once approved, you’ll see a new informational window in your basic Apple Card info screen:

See those two with the blue box graphic? “Savings Account: Current Balance: $0.00” and “Your Savings Account is Ready”. All set up. You can stop here and just let it slowly accumulate your Daily Cash rewards from card usage, but let’s do something else…

TRANSFER MONEY INTO YOUR NEW SAVINGS ACCOUNT

It’s surprisingly easy to transfer money into your new Savings account because it’s simply debited from your associated bank account. When you tap on “Savings Account’ it shows your current balance with a graphic representation of balance over time. I’ve actually already transferred $50 in as a starter, as you can see:

You can add more money at any time with the black “Add Money” and specify how much to transfer. That’ll then immediately show up in your balance and your graph will go from zero to a solid blue display like what I have above.

Mission accomplished. Daily Cash will automatically be added to your Savings and if you now just ignore the account, it will slowly but surely accrue in value, a balance you can withdraw as needed at any time!

Pro Tip: I’ve been writing about the Apple Card since it was launched, along with a lot more about shopping online, etc. Please check out my Amazon, eBay and Online Shopping Help for more tutorials on this subject!